The Crypto Market Bounces Back: January Sees a 20% Recovery in the Last Thirty Days

The crypto market is making a gradual recovery from the crash it experienced in November. However, December did not meet the expectations of many investors, as most cryptocurrencies did not see significant increases in value. This can be attributed to the low trading volume during that time.

Fortunately, January brought new opportunities and a change in sentiment. The sector started off slowly, but gradually gained momentum as the month progressed. Leading cryptocurrencies like Bitcoin and Ethereum led the way, reaching levels they haven’t seen since November 2022.

These positive developments were reflected in the global cryptocurrency market cap, as we witnessed changes in its value. The month began with a market cap of $800 billion, which dipped slightly below that figure at one point. However, it peaked at $1.08 trillion and is currently valued at $1.05 trillion.

This indicates that the overall cryptocurrency market has gained more than 24% in the past thirty days. Some individual assets have also seen significant price changes. The accompanying image showcases the performance of various cryptocurrencies during this period.

The image above displays the performance of altcoins over the past thirty days. APT stands out as one of the top gainers, with an increase of almost 400%. It experienced a massive rally, starting the day at $12 and reaching a high of $18.9 after failing to reach $19. Ultimately, it closed with gains of over 40%.

DYDX is also among the top gainers, with an increase of over 170%. While these performances are exciting, let’s now examine how some of the cryptocurrencies in the top 10 have fared.

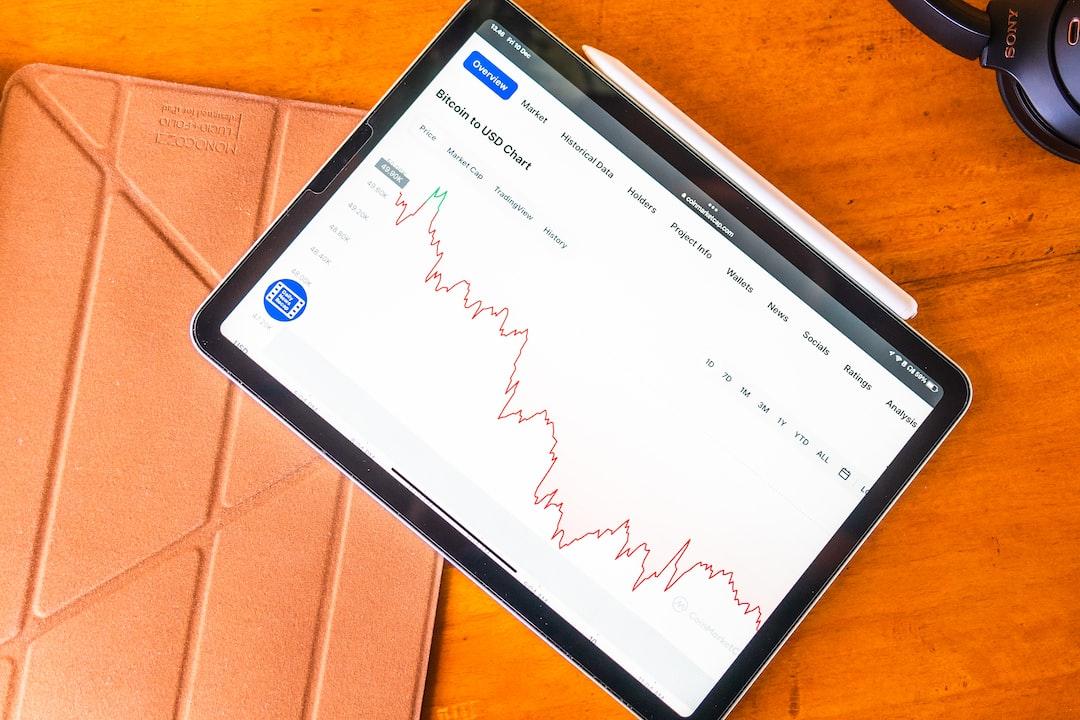

BTC/USD (Bitcoin) had one of its best performances in the past thirty days. Although it started off slowly, it gained momentum and broke through multiple resistance levels. The breakthrough at $18,000 sparked significant reaction, and the momentum continued to build in the second week.

The next milestone was $20,000, which Bitcoin surpassed on January 14. It’s worth noting that most of the surges occurred over the weekends. Traders were thrilled when the $22,000 resistance level was broken a few days later, as it hadn’t been reached since September.

On a monthly scale, Bitcoin performed exceptionally well. It began the month at $16,530, experienced a dip, and then reached a high of $23,954. It is now valued at $22,929, indicating a gain of almost 40%.

ETH/USD (Ethereum) also saw remarkable performance, breaking through resistance levels one after another. This led many to consider the possibility of Ethereum surpassing Bitcoin, as previously predicted. However, it had its own ups and downs.

Ethereum began the month at $1,195 and had a slow start. After several small price movements, it broke out and gradually surpassed $1,300, aiming for $1,400. January 14 was a significant highlight, as Ethereum surpassed $1,500. It opened the day at $1,450 and attempted to reach $1,600, but faced strong resistance at $1,591. Nevertheless, it ended the day with gains of almost 7%. It is currently valued at $1,576 and may end the month with a positive change of over 30%.

BNB/USD (Binance Coin) was mostly bullish in the past thirty days. Although it started off slowly, it quickly gained momentum and overcame several barriers. The first resistance level it surpassed was $280. The second week of January brought more volatility, with five consecutive green days for Binance Coin.

The next significant milestone was surpassing $300 on January 14. Similar to the other cryptocurrencies, most of the surges occurred over the weekends. Traders were ecstatic when the $320 resistance level was broken a few days later, as it was the first time since September that Binance Coin reached that mark.

Binance Coin had an impressive monthly performance, starting off at $246 and reaching a high of $323. It is currently valued at $311, indicating a change in price of almost 30%.

In conclusion, the crypto market has shown signs of recovery in January, with major cryptocurrencies experiencing significant gains. It remains to be seen how these trends will continue in the coming months.