Interview with Jason Williams, of Morgan Creek Digital, and His Daughter

With Bitcoin being just over a decade old, there is still speculation about whether it will become the “digital gold” for the younger generation or not. A previous survey showed that the majority of young Americans preferred a $1 bill over 1 BTC, even though the latter was worth more. However, there are exceptions to this trend, like 12-year-old Ginger, the daughter of Jason Williams, co-founder and partner at Morgan Creek Digital, who has gone all-in on Bitcoin, hoping for its future value to increase.

In an exclusive interview with Williams and Ginger, we delved into their perspectives on Bitcoin and their involvement in the cryptocurrency space. While it is no surprise that Ginger learned about Bitcoin from her father, Williams shared his own early experience with cryptocurrencies, which involved his co-founder at Morgan Creek Digital, Anthony Pompliano. Williams started a crypto mine with Pompliano in 2015/16, mining Ethereum with GPUs initially and later expanding to a 700KW ASIC mine in Virginia. He further expanded his mining operations to 1.4MW of ASIC miners. Through this, Williams gained exposure to various aspects of the crypto industry, such as hardware, pools, exchanges, trading, custody, taxes, altcoins, and Bitcoin, setting him up to become a significant contributor to the industry.

After co-founding Morgan Creek Digital Assets, Williams and his team focused on raising institutional funding for the crypto industry. In February 2019, they achieved significant success by raising $40 million in a venture capital fund, with the first U.S. Public Pension funds and a group of institutional investors anchoring the fund. Williams revealed that Morgan Creek’s crypto-focused fund has raised about $130M in AUM so far, having made over 30 equity investments in blockchain technologies focused on infrastructure and holding liquid positions in BTC. However, the current recession and pandemic have limited their efforts to attract more institutional investment, with only funds that have established relationships finding success.

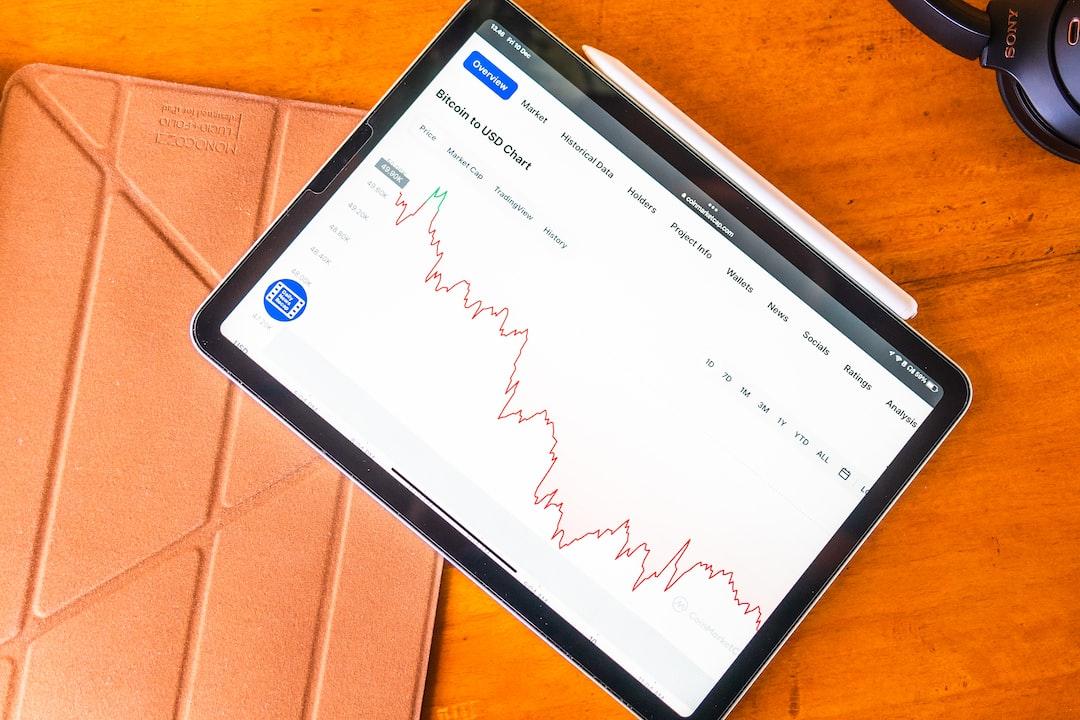

When asked about the potential price of Bitcoin after the 2024 halving, Williams predicts that the price will be between $56k and $288k. As for Ginger, she believes that Bitcoin is money, although she acknowledges that it is currently unusable. However, she sees its potential for becoming usable and important in the future. Ginger also compares mining to computers supporting the internet and mentions her friends using digital currencies in popular screen games like Fortnite and Apex Legends. She finds Bitcoin cooler than in-game currencies like Vbucks and Apex coins because Bitcoin allows users to buy and own things. She hopes that Bitcoin will be used for buying and owning in-game skins and that they can be given to friends. While Ginger currently only knows about Bitcoin, she expresses interest in learning more about other cryptocurrencies.

Overall, the future of Bitcoin as “digital gold” for the younger generation is still uncertain, but there are individuals like Ginger who believe in its potential and are willing to invest in it.