47k Ethereum Tokens Transferred to Coinbase by Ethereum Whales During ETH Price Slump

Ethereum whales have made significant transactions involving a large number of ETH tokens in the past 24 hours, against the backdrop of a global crypto market crash and a notable dip in ETH price. This has led to speculation among market participants about the reasons behind these transfers and their potential impact on the token’s value going forward.

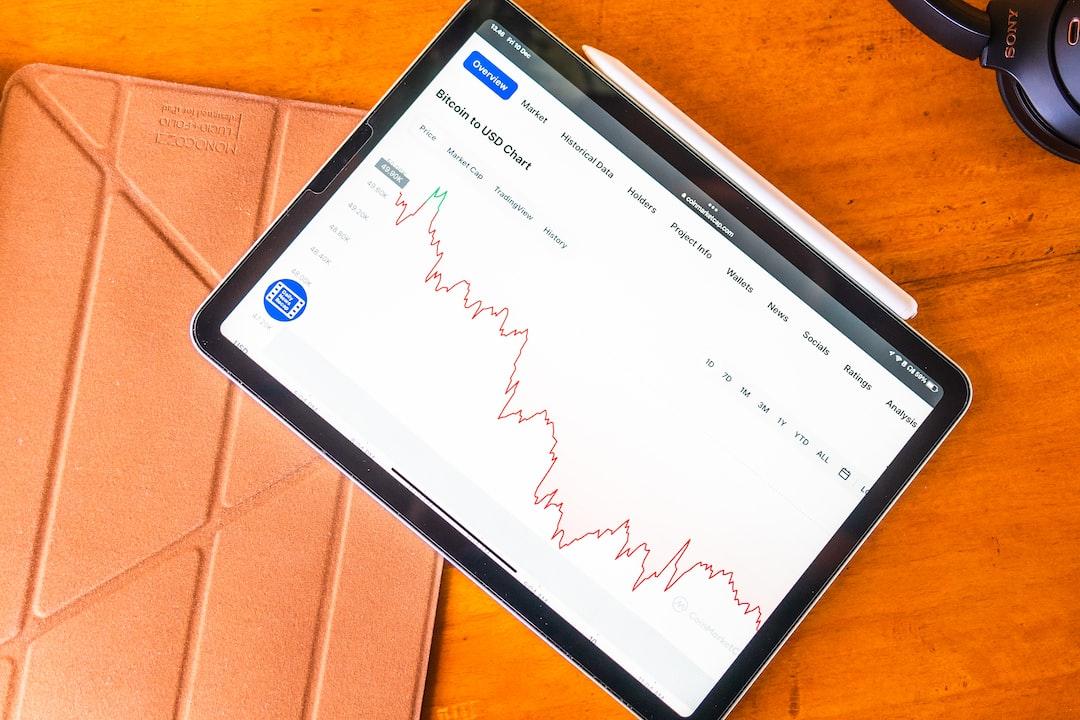

The overall crypto market capitalization has experienced a steep decline, dropping by 8% to reach $2.11 trillion in the last day. April ended on a negative note, with most tokens trading in the red, as indicated by the crypto heat map by CoinMarketCap. Consequently, Ethereum, the second-largest cryptocurrency by market cap, has lost 8% of its value and is now trading below the $3,000 mark.

Amidst the price slump, large investors are carrying out transactions, which further raises doubts about a potential price recovery. Let’s delve into the details of these transactions.

WhaleAlert, a tracker for large cryptocurrency transactions, has detected three separate transfers involving at least 10,000 Ethereum tokens being sent from wallets to the popular centralized exchange. Approximately 10 hours ago, the first transaction moved a substantial 25,060 ETH (worth $75,685,145) from an unknown wallet to Coinbase Institutional.

Shortly after, another transaction took place, transferring exactly 10,924 ETH tokens (valued at $32,892,642) from another unidentified wallet to the Coinbase exchange. And it didn’t end there. About 8 hours later, the last transaction occurred, carrying 10,902 ETH coins with a value of $31.6 million.

These significant amounts of ETH being moved to the Coinbase exchange have caught the attention of the crypto community, as members closely observe these movements for insights into market activities. The behavior of whales, who are profiting from the possibility of gains in the absence of a post-halving rally, has added to the general sense of apprehension among Ethereum users.

It’s worth noting that these transfers and the price dip coincide with the recent sentencing of Binance founder and former CEO, Changpeng ‘CZ’ Zhao, who received a 4-month prison sentence on April 30. Additionally, the uncertainties surrounding the classification of Ethereum as a security have contributed to the sell-off and increased market volatility.

Meanwhile, Ethereum is following the broader crypto market’s downtrend. According to the latest data from CoinMarketCap, the price of Ethereum currently stands at $2,867, representing a 5.80% decline at the time of writing. However, the trading volume of Ethereum has surged within the recorded period. The data shows that ETH’s 24-hour trading volume has increased by 39.5% to $20.07 billion, maintaining a live market cap of $350.3 million.

Upon closer analysis of derivatives data, ETH’s open interest has decreased by 8.30%, and its current valuation is $7.6 billion. This drop in open interest highlights the rapid changes in Ethereum’s market dynamics and their potential impact on trading activity and investor confidence.

Tags: eth, Ethereum, ethereum whale