Analyst Report Indicates Ethereum May Decline to $2,850 unless Certain Conditions are Met

Ethereum, the second-largest cryptocurrency, is on the brink of a significant drop in value, falling from its current price of $3,310 to $2,850. Well-known blockchain analyst Ali Martinez took to Twitter to explain what factors could prevent this 15% decline from occurring.

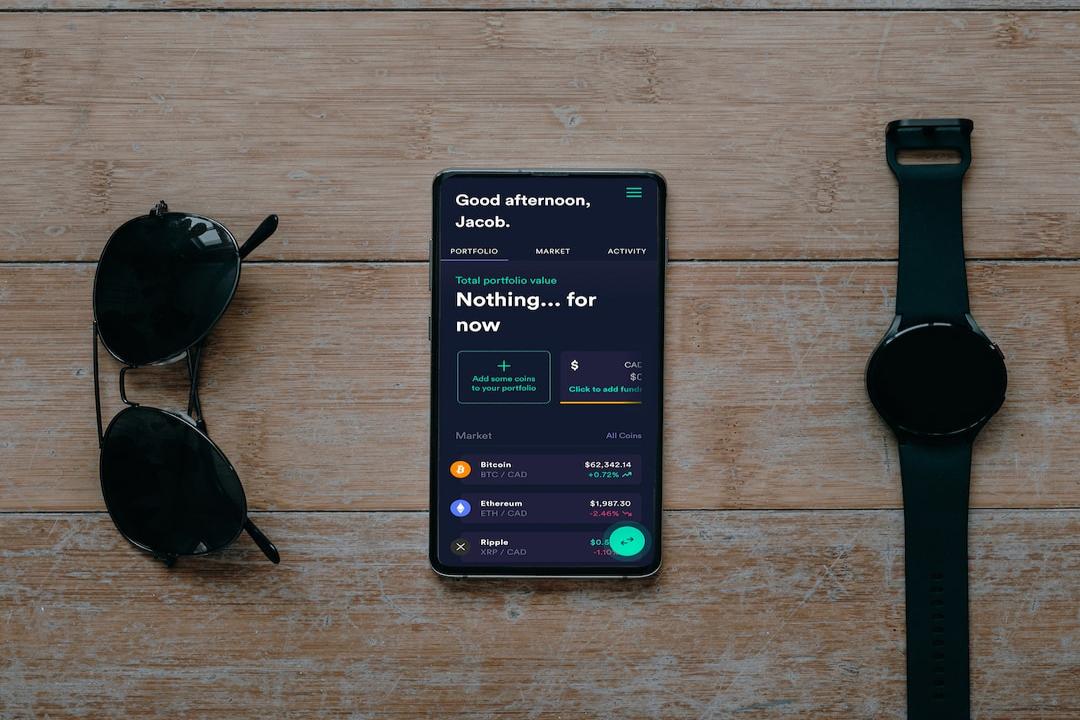

ETH’s recent price drop is in line with the trend witnessed by other major cryptocurrencies. In the past 24 hours, Ethereum has experienced a 7.19% decrease, while Bitcoin (BTC), SOL, and XRP have also seen significant declines, reaching $65,700, $180, and $0.58, respectively.

The analyst reveals that the current price of ETH, at $3,330, lacks a support level. A support level typically consists of two similar prices where a large number of investors have accumulated a substantial amount of the asset. Without this support, Ethereum’s value is likely to drop to $2,850 or even lower.

The recent surge in Ethereum’s value was fueled by the overall bullish trend in the crypto market. Additionally, the popularity of Ethereum-based memecoins, like Dogecoin, contributed to its price surge. The anticipation of the Dencun upgrade also played a role in the bull run. However, after the upgrade took place last month, there was no significant movement in the value of ether.

The potential approval of an Ethereum ETF product could drive ETH’s price. Investment companies such as Grayscale, BlackRock, and Franklin Templeton have applied for an ether-based ETF product. However, the chances of approval remain slim, with the United States Securities and Exchange Commission (SEC) only giving it a 25% chance of being approved. This pessimistic view is due to the SEC classifying ether as a security and implying that Ethereum creators should register the cryptocurrency with the agency, subjecting it to regulations governing the securities market.

Given the low likelihood of approval in the near future, Ethereum’s value is expected to remain within its current price range for an extended period.

Tags: Ethereum