Solana’s TVL in DeFi Surpasses $4.4 Billion, Marking its Highest Point in Nearly Two Years

The DeFi sector of Solana, a smart contract-enabled layer-1 blockchain network, has achieved a significant milestone by recording a total value locked (TVL) of $4.4 billion, marking its highest TVL in the past 23 months. This comes as Solana continues to attract investors’ attention and experience ecosystem growth. Additionally, Solana’s native coin, SOL, has also seen a rise in value.

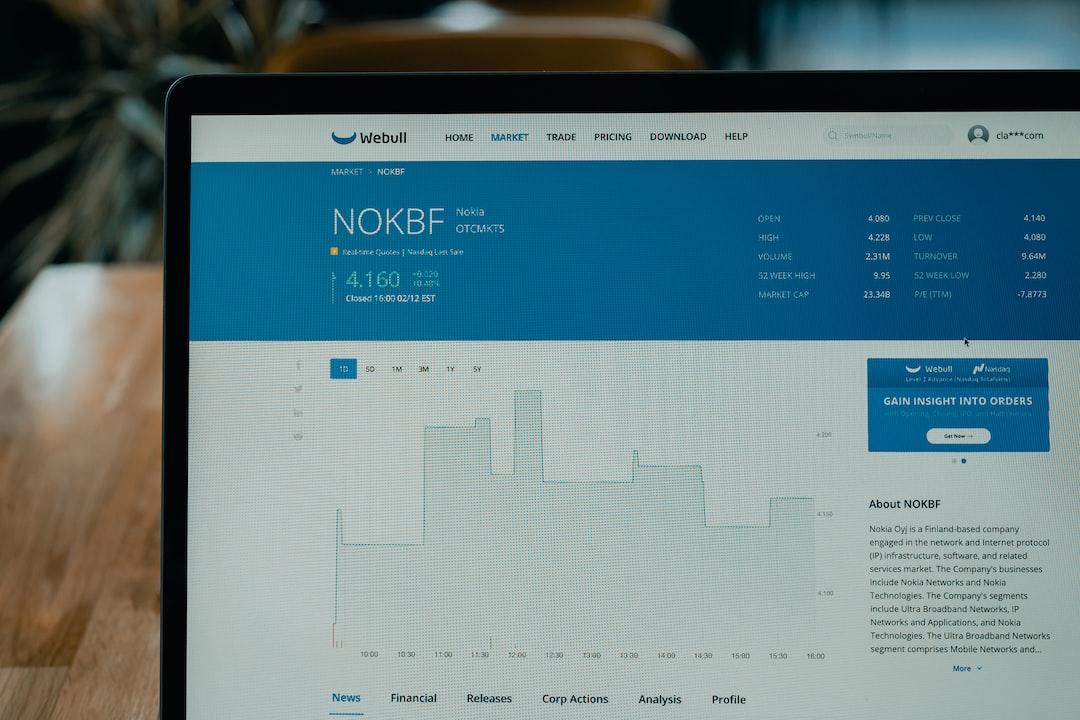

According to data from the blockchain analytics platform DeFiLlama, Solana’s DeFi sector reached its highest TVL of $4.82 billion on April 5th, 2022, within the past two years. However, in the following months, several DeFi projects on the Solana mainnet experienced downtrends, largely due to the FTX collapse, resulting in some platforms even leaving Solana. The chart above illustrates the depreciation of TVL throughout the previous year.

Several DeFi projects, including Marinade, Jito, Kamino Finance, MarginFi, and Raydium, contributed to the market’s surge to $4.4 billion. It is worth mentioning that Solana’s DeFi sector surpassed $2 billion in TVL just last month.

The all-time high TVL for Solana’s DeFi sector occurred in early November 2021, during the peak of the bull run, surpassing $10 billion.

This record in Solana’s DeFi TVL coincides with significant growth in its decentralized exchange (DEX) market.

Solana has made a remarkable recovery from its challenging period last year, as it has become home to numerous crypto projects, particularly memecoins. The blockchain is now widely recognized as a meme chain.

SOL, Solana’s native coin, has also experienced substantial growth, currently trading at $192, representing an 8.8% increase in the past 24 hours.

Tags: Solana