Uniswap UNI Price 18 Million Sold by Longterm UNI Holders Amid Regulatory Concerns

Uniswap (UNI), the token native to the decentralized exchange platform Uniswap, has seen a sharp decline in price after the U.S. Securities and Exchange Commission (SEC) issued a Wells Notice to the platform on April 9, 2024. This notice indicates that the regulator intends to recommend enforcement action against Uniswap, causing concern among investors and leading to a significant sell-off of UNI tokens.

In the last 72 hours, the price of UNI has dropped to a 50-day low of $8.9, resulting in a loss of over $1.3 billion in market capitalization. This decline follows the SEC’s announcement and has been driven by long-term UNI holders selling off approximately 1.7 million tokens, worth an estimated $18 million, in response to the regulatory crackdown.

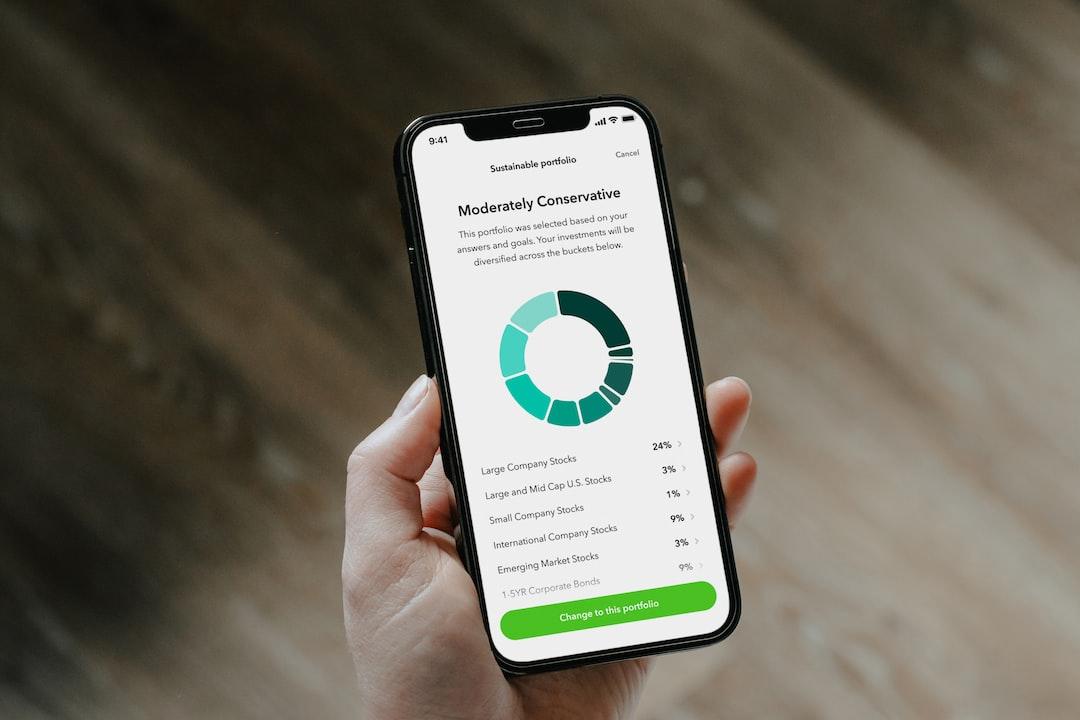

On-chain data analysis shows an excess of sell orders compared to buy orders, suggesting further downward pressure on the price in the coming days. This imbalance in market depth indicates that UNI’s price may continue to decrease, especially if Uniswap’s legal team is unable to provide a satisfactory response to the SEC’s notice.

The SEC’s decision to target Uniswap represents a notable shift in the regulatory body’s approach to the cryptocurrency industry, particularly decentralized exchanges. This development has raised concerns among investors and industry experts about the potential implications for the broader decentralized finance (DeFi) ecosystem.

Despite the challenging situation, Uniswap’s team has expressed their determination to mount a strong defense against the SEC’s allegations. Marvin Ammori, Uniswap’s Chief Legal Officer, has stated that the platform is prepared to fight the charges in court if necessary.

As the situation unfolds, investors and traders are closely monitoring UNI’s price action and the potential ramifications of the SEC’s enforcement efforts. While some experts believe that the SEC’s move could set a precedent for increased scrutiny of DeFi platforms, others argue that the unique characteristics of decentralized exchanges may ultimately limit the regulator’s ability to exert control over the sector.