UK to Implement Regulations for Digital Assets by 2024

The government of the United Kingdom made an announcement on Monday, confirming its commitment to regulating the cryptocurrency sector by next year. This decision comes in response to a consultation paper released earlier this year, which called for clear regulations to govern the use of cryptocurrencies in the country, starting with stablecoins.

The government’s response to the consultation paper was published in a document that highlighted the views of the HM Treasury on the matter. The consultation paper was made public on February 1 and closed for feedback on April 30, 2023.

The proposed regulations outlined in the published document would cover various aspects of the crypto industry, including crypto-asset offerings, stablecoin issuance, trading platform operations, and the operation of custodian and lending services firms.

The Financial Ministry explained that these regulations were developed in response to recent events, such as the collapse of the cryptocurrency exchange FTX. The ministry also stated its intention to incorporate these guidelines into existing market laws, rather than having them exist as a separate regulatory regime.

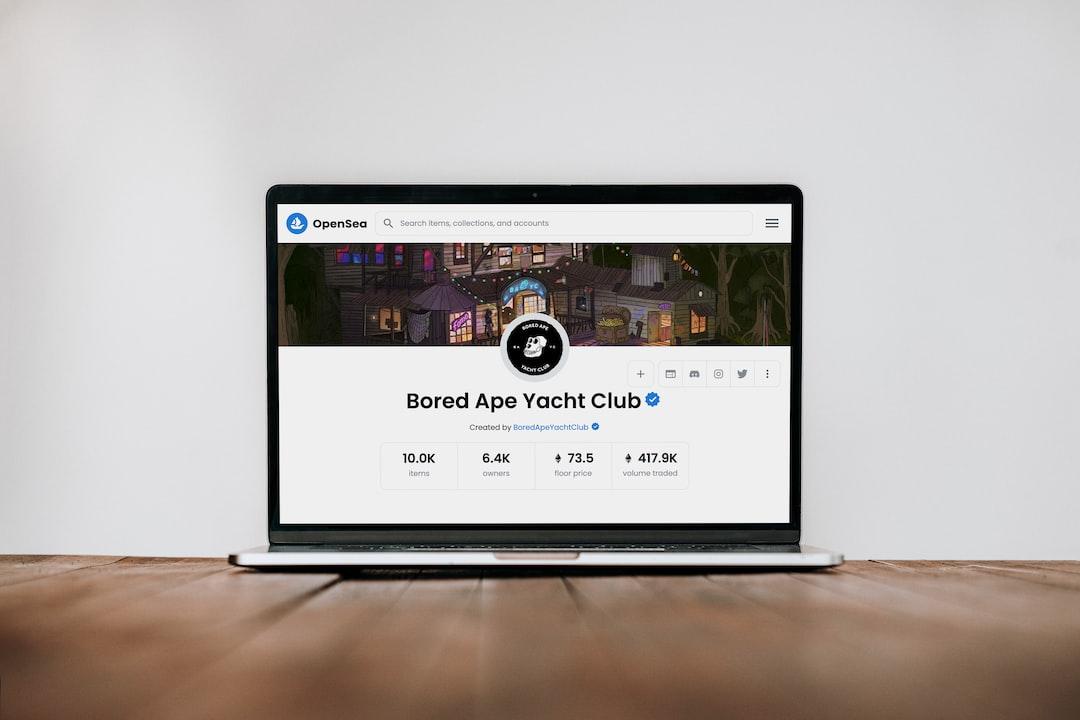

In its response, the HM Treasury emphasized that the regulatory regime should exclude certain areas of the digital asset space, such as NFTs. The ministry also recommended a cautious approach to decentralized finance (DeFi) and ruled out airdrops for the time being.

Unlike its US counterpart, the UK government has been supportive of digital innovations in the cryptocurrency sector. Even before the implementation of official regulations, UK regulators have created an environment that encourages crypto innovation to thrive.

Andrew Griffith, the financial services minister, expressed his ambition for the UK to become a global hub for crypto asset technology in a statement.

Tags: Regulation, United Kingdom